Ah, the woes of being a Gen X entrepreneur! Let me paint you a picture of true financial stress, worthy of a soap opera plot… the emotional rollercoaster of stressors business owners deal with that can cause brands to stall or fail altogether, along with some effective fixes.

The culprits? Caregiving nightmares, the absence of a financial safety blanket and the looming black hole known as retirement savings.

I’m not just any entrepreneur. Like you, I’m also in that sweet spot between boomers and millennials – call me the generational middle child.

Picture this…

I’m the star of the Sandwich Generation circus, sandwiched between the demands of raising grandchildren, handling adult children and catering to the needs of my aging parents. It’s like a daily tightrope walk over a pit of financial stress.

Now, let me spill the tea on our major stressors as business owners in our generation. Brace yourself for the financial rollercoaster, where we battle dragons while trying to keep our sanity intact.

But fear not, because I’ve got some ingenious tricks up my sleeve to outsmart the chaos. Because, hey, who doesn’t love a good financial survival guide for the Gen X hero?

3 Major Stressors Gen Xers Deal With Exclusively That Add to the Emotional Rollercoaster

Ah, let’s dig deeper into the Gen X financial saga, shall we? As if being sandwiched between boomers and millennials isn’t dramatic enough, we former Latchkey Kids have got our unique set of stressors. I mean, who needs a simple life, right?

1. The Caregiving Circus

So, here we are, stuck in the middle of the “sandwich generation” – financially responsible for both our parents and our kids. It’s like juggling flaming torches, but with bills instead.

We’re sacrificing:

- Retirement savings

- Emergency funds

- Debt payoffs

…you name it… just to financially assist our adult children. Talk about being the unsung heroes of multitasking!

Genius Solution

What’s the answer, you ask? Well, there isn’t a simple one. Balancing physical, emotional, and financial support for our loved ones while trying to maintain some semblance of work-life balance – it’s a real-life circus act.

But hey, we gotta do it for those adorable grandkids. They’re the key to our sanity, joy, and, let’s be real, potential heirs to our small business empires.

2. Retirement Savings Limbo

Now, let’s talk about the age-old issue of feeling like we’re light-years behind on retirement savings. Thanks, Bankrate, for confirming that 45% of us Gen Xers feel like we’re stuck in a financial time warp.

Blame it on inflation, the sneaky culprit that’s been messing with our ability to save, invest and pay down debts. It’s like trying to outrun a financial treadmill set on warp speed.

Genius Solution

So, we’re stuck with the absence of pensions like our baby boomer parents had, left to fend for ourselves. But fear not, my comrades, we’ve got a trump card – build our businesses now!

Transform that dormant brand into a financial fortress. Don’t wait until retirement; invest in branding and marketing now so that when the golden years roll in, our businesses are the lifeline.

3. Emergency Savings Drama

Emergency savings – the financial superhero cape we wish we had more of. But alas, more than half of us (62%, to be precise) are feeling uneasy about our emergency funds.

It’s like having a superhero suit with a few missing buttons – not ideal.

Genius Solution

The experts say we should aim for six months’ worth of expenses. Great advice, but let’s be real – it’s easier said than done. The key is a well-stocked emergency fund that can cushion the blow of unexpected expenses, be it caring for a loved one or fixing that leaky roof.

Set it aside in a liquid bank account, automate those contributions, and voila – a superhero cape that doesn’t need alterations.

Oh, and for more wisdom on creating that financial cushion, check out our article on Cushions for Gen X – because we could all use a bit more comfort in this financial and emotional rollercoaster.

Cheers to weathering the storm, my fellow Gen Xers!

Gen X’s Emotional Rollercoaster: Triple Whammy of Storms Within 25 Year

Now, let’s dive into the financial rollercoaster that is Gen X’s journey. Brace yourselves, my fellow warriors, for we’ve been through not one, not two, but three major setbacks within a mere 25 years. It’s like dodging financial bullets – Matrix-style.

The Panoramic View

To truly grasp the roots of our financial anxiety, savvy Gen X CEOs advise taking a panoramic view of the triple whammy we survived within a 25-year period:

Imagine this:

- We kicked off our careers during the dot-com bubble burst in the late ’90s when quickly flopped, leaving many hanging on for dear life financially

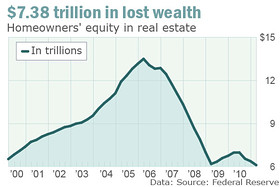

- Fast forward a bit, and boom – the Great Recession knocked on our doors less than a decade later, creating the housing marking crash of 2008, a bubble that burst so loud the boom was heard around the globe

- And just when we thought we’d caught a break, the 2020 coronavirus recession joined the party and left many small businesses scrambling after being denied infamous PPP loans

Yep, we got hit three times in 25 years, leaving us with some hefty financial battle scars.

How Xers Puffed Up the Bubble

Now, for the plot twist – how did we, the resilient Gen Xers, reinflate the bubble? Turns out, the bulk of our wealth leans on our homes, our ultimate financial superheroes.

Despite taking a beating during the housing collapse a decade ago, we defied the odds. Pew Research Center crowned us as the only generation to bounce back, recovering the wealth lost during the Great Recession.

Over the past decade, our median net worth skyrocketed by 115%, as we clung to our assets and kept hustling. We even doubled our home equity levels since 2010, according to the wise analysts at Pew Research Center.

No Relief in the Lap of Recovery

But hold onto your financial hats – despite this impressive recovery, we, the resilient Gen X, are the least likely to feel financially secure compared to our counterparts from other generations.

We’re less optimistic than younger generations about achieving financial security. It’s not just financial factors at play but also psychological and cultural elements.

Cue the Nostalgia

Remember those personal finance books from the ’90s? They were all about real estate, spending less than you earn, and the beauty of rugged individualism.

And let’s not forget the flavor of feminism that shaped our style – tough, no-nonsense, and a firm no to complaining.

So, here we are, with this unique set of stressors, navigating the financial wilderness with our Gen X flair. Who said the journey to financial security was a walk in the park?

Real Tales from the Financial Trenches: Gen X in the Sandwich Blender

Now, let’s zoom into the gritty reality with the true stories of Gen Xers who found themselves smack dab in the middle of the Sandwich Generation chaos… another prime reason for their emotional rollercoaster.

Gen Xer Leaves 9-to-5 for Mom’s Sake

Meet Jordan Morales, a 48-year-old quality assurance manager in Riverside, CA, who knows the dance of financial anxiety all too well. In 2007, he made a life-altering decision to leave his cushy 9-to-5 government job. The reason?

His mother, battling Alzheimer’s and stage three breast cancer, needed a full-time caregiver. Jordan, optimistic about America’s “dependable and constantly growing” economic strength, bid farewell to stability.

Fast forward to 2008, and cue the ominous music – the economy plunged into a full-blown recession. The bubble had burst, thanks to the Baby Boomers.

Regret, stress, and anxiety hit Jordan like a freight train. In 2009, he was just one of 2,500+ applicants for numerous positions, facing a daunting job market.

But the story doesn’t end in despair. Years later, Jordan became a best-selling author on Amazon, sharing his caregiving journey. He launched online courses to aid others caring for Alzheimer’s patients.

Alongside personal triumphs, he faced challenges – his mother’s passing, the birth of twins, and the amputation of his diabetic dad’s legs.

In 2020, when his wife’s job status was deemed ‘nonessential,’ eBook royalties and course enrollments became their financial lifeline until things got back to ‘normal.’

Gen Xer’s Business Struggle: Granny Edition

Then there’s Sabrina Peterson, a 53-year-old entrepreneur, living the hustle. Facing a unique challenge, Sabrina had to juggle her business and care for her elderly grandmother. Why?

Because her Baby Boomer kids weren’t up for the caregiving task.

Moving in with Granny, Sabrina expected a simple arrangement, considering she worked from home.

Little did she know, dealing with a dementia-stricken elderly woman in alternating fits of rage and toddler-like tears was no walk in the park. Faced with the risk of her business failing,

Sabrina had to make the tough call – renting an office space and hiring help for Granny during the day.

The saga continued with sleepless nights safeguarding Granny. But this was just practice for what lay ahead – caring for her aging Baby Boomer mother and cancer-stricken adult daughter in the years to come.

Today, with her grandmother and mother no longer in the picture, Sabrina resides in Granny’s home, raising three grandchildren left behind after her daughter’s passing.

The Sandwich Generation & the Weight of Finances

The tales of Jordan and Sabrina echo the struggles of many Americans in their 40s and 50s, sandwiched between financial responsibilities.

Whether it’s caring for aging parents, supporting adult children and grandchildren, or juggling work and retirement savings – the financial blender is on full speed.

The majority of us Gen Xers (ages 43-58, but who’s counting?) are feeling the financial weight. About 60 percent of us claim money has a negative impact on our mental health, a significant jump from the previous year’s 46 percent.

In Sabrina’s words, our financial journey can be a wild rollercoaster, swinging between feeling secure and free-falling. Welcome to the Sandwich Generation – where financial acrobatics are part of the daily routine.

Creating Sustainable Income for Gen Xer’s Retirement

As a business owner representing the Generation X Society, you must give your business

the competitive edge it deserves. It’s time to turn the tide and pave the way for a retirement that doesn’t involve endless financial juggling.

Crafting Your Financial Legacy: A Blueprint for Gen X Entrepreneurs

As a proud member of the Generation X Society, you’ve weathered the storms, faced financial dragons, and juggled the demands of the Sandwich Generation.

Now, let’s flip the script and ensure your business not only survives but thrives, securing a retirement that’s not plagued by uncertainties.

Step 1: Master the Art of Branding

Don’t just be a business; be a brand powerhouse. Inject life into your dormant brand, transforming it into a solution for your financial hurdles. It’s not about waiting until retirement; it’s about building your brand now.

Pour your energy into robust branding and marketing strategies, ensuring your business becomes a financial fortress when you decide to hang up your entrepreneurial cape.

Step 2: Don’t Wait – Build Your Empire Now

The secret weapon to a stress-free retirement lies in the present. Don’t procrastinate; take charge now. Pour your heart and soul into your company, shaping it into an empire that sustains you even after you’ve stepped away.

Waiting until retirement is a luxury we can’t afford – seize the opportunity today.

Step 3: Secure Your Emergency Cushion

Emergency savings are the unsung heroes of financial stability. As a Gen X business owner, ensure your emergency fund is not just a safety net but a trampoline, ready to bounce back from unexpected financial hurdles.

Aim for at least six months’ worth of expenses in a liquid account. Automate your contributions, making it a seamless part of your financial routine.

Free Guide: Navigating Your Financial & Emotional Rollercoaster

Now, the pièce de résistance – our gift to you. Download our free guide on navigating the intricate landscape of your target market. In the competitive world of business, understanding your audience is the key to success.

This complimentary guide is your compass, leading you to the right audience that fuels your business growth.

Remember, fellow Gen Xer, this is not just a guide. It’s your ticket to crafting a sustainable income for retirement.

Embark on the journey, and let’s secure the financial future you truly deserve. Click the button below now.